Not known Factual Statements About Opening An Offshore Bank Account

Table of ContentsOpening An Offshore Bank Account - The FactsOpening An Offshore Bank Account Can Be Fun For EveryoneSome Known Factual Statements About Opening An Offshore Bank Account The 10-Second Trick For Opening An Offshore Bank Account

If the youngster is not able to offer address verification documents in their very own name, we can accept those of a parent/guardian given the surname and address are precisely the very same. If you have a various last name, we will require to see a legal document such as a long birth certificate.

Pupils who desire to open a UK checking account might need a letter of intro from the College to give to the bank when they relate to open an account. Typically only international pupils will need this letter, if you are a UK trainee a certificate of registration which you can produce from the S3P trainee site will usually be sufficient to confirm your standing as a trainee.

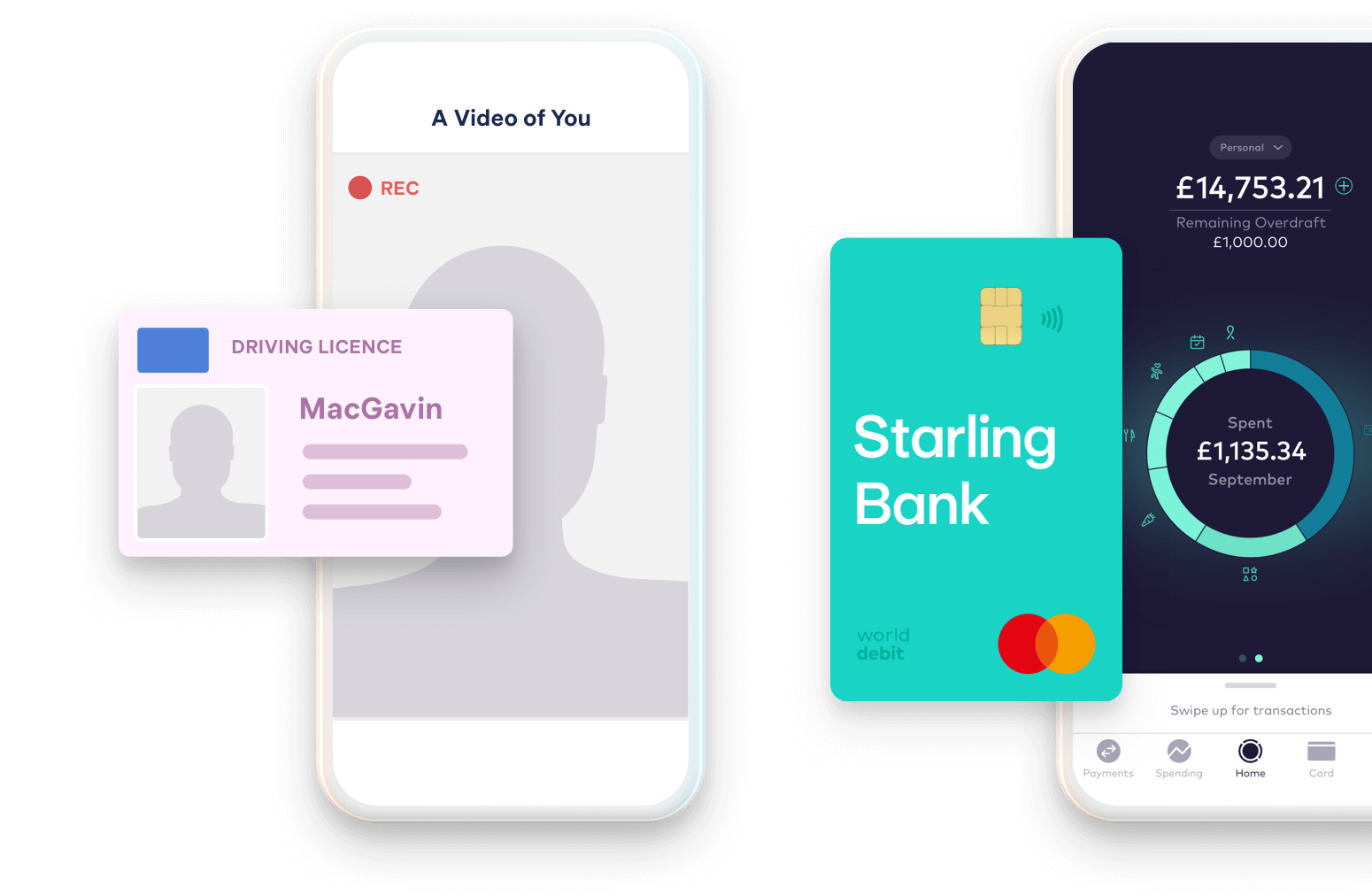

If you are having a hard time to book an in-person appointment with a financial institution, you might be able to locate an on the internet consultation at an earlier day. Additionally, you could join an on the internet financial institution. Some instances of banks include: Santander HSBC Lloyds TSB Barclays Nationwide Revolut (on-line bank) Starling (online financial institution) Monzo (online financial institution) (opening an offshore bank account).

The Best Strategy To Use For Opening An Offshore Bank Account

Having a checking account is thought about among the basic indications of economic stability. It shows that an individual has their funds in control as well as enables them accessibility to other banking products. In numerous methods, a financial institution account holds the key to the entire world of financing. It is a globe that is obstructed off for many who discover it tough to obtain on the very first step of the monetary ladder by opening a financial institution account.

Below are some actions you can take if you have had difficulty opening a current account with a financial institution or structure culture: Inspect Your Debt Report If you have been rejected for a bank account since of a poor credit rating, you need to check exactly what your debt report claims.

It will certainly give you with details of any kind of borrowing you have actually made in the past as well as information of any type of missed payments. Financial institutions and also banks additionally use your credit history report to validate your identity. Take the time to experience your report to learn if there is any type of incorrect info had in it.

You can test any kind of aspect of your credit rating while you must also make sure that all the information regarding your identity are exact and also up to day. Basic Bank Accounts You can likewise check out the choice of opening up a basic savings account. These are accounts that do not use debt cards or overdraft account centers.

The Ultimate Guide To Opening An Offshore Bank Account

Some standard financial institution accounts include a regular monthly cost as well as a minimum monthly down payment demand. Prepaid Cards If you can not open up a bank account, you can still obtain a debit card by discovering the several choices for pre paid cards. A pre-paid debit card operates in similarly as a normal debit card because it has a reference card number as well as expiration day as well as a CVC number on the description back.

You must pack funds onto the card to use it and also you can only spend the cash that is on the card any time - opening an offshore bank account. This means there is no credit scores entailed and consequently it is a great choice for someone that can not open up a savings account due to credit rating troubles.

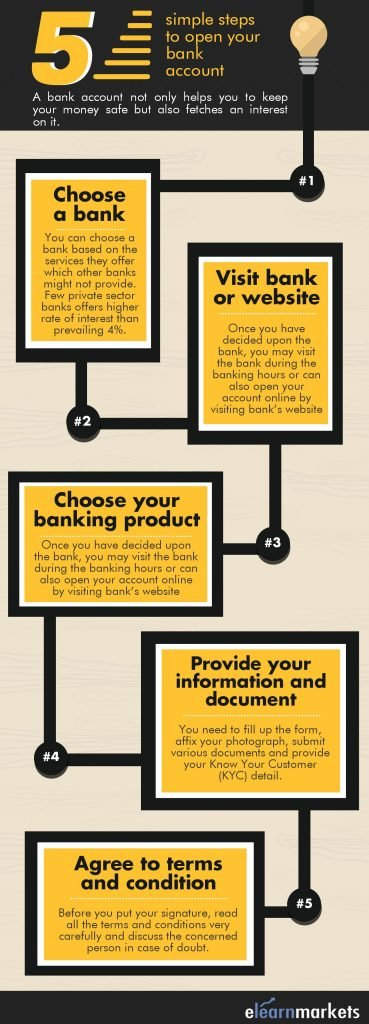

Coronavirus (COVID-19) financial upgrade Applications for payment vacations have now shut yet financial institutions are still supplying tailored support to clients who are impacted by the coronavirus break out. Keep top of the most recent news as well as advice associated to the COVID-19 pandemic with Which? Prior to you start: exactly how to compare savings account Opening up a bank account is an essential monetary landmark.

Choosing the right current account will depend on the means you spend and manage your cash. Here are some things to think about when contrasting accounts: Does the next bank have a good track record?

Some Known Factual Statements About Opening An Offshore Bank Account

If you're opening an account from scrape, it will certainly depend on the way you open the account. For example, Santander says successful on the internet candidates will be sent their account details and debit card within 7-10 functioning days but if it can verify your identification over the phone, you'll be able to open up the account right away.